salt tax cap news

Current law allows taxpayers to deduct any state and local taxes SALT paid from their gross income when they file for federal returns. The climate change deal brewing in Congress which would fund the massive investment in clean energy with new taxes on.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

California Approves Workaround to SALT Deduction Cap.

. 2 minutes In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep. Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction. Households making 1 million or more a year would receive half the benefit of repealing the 10000 federal cap on the state and local tax SALT deduction a study by the.

The Tax Policy Center estimates a full repeal of the SALT cap would cost about 450 billion over the first five years while the Tax Foundation estimates it would cost about. The state Franchise Tax Board reported that in 2018 the SALT cap cost Californians 12 billion. In 2017 Trumps wide-ranging tax.

While the 10000 ceiling on. The deduction has a cap of 5000 if your. This limit applies to single filers joint filers and heads of household.

Tom WilliamsCQ-Roll Call Inc via. A new bill sponsored by a pair of Democrats in the House of Representatives seeks to repeal the 10000 cap on state and local tax deductions. The SALT deduction cap would stay at 10000.

The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. Tom Suozzi writes For 100 years Americans relied on this deduction. 52 rows As of 2019 the maximum SALT deduction is 10000.

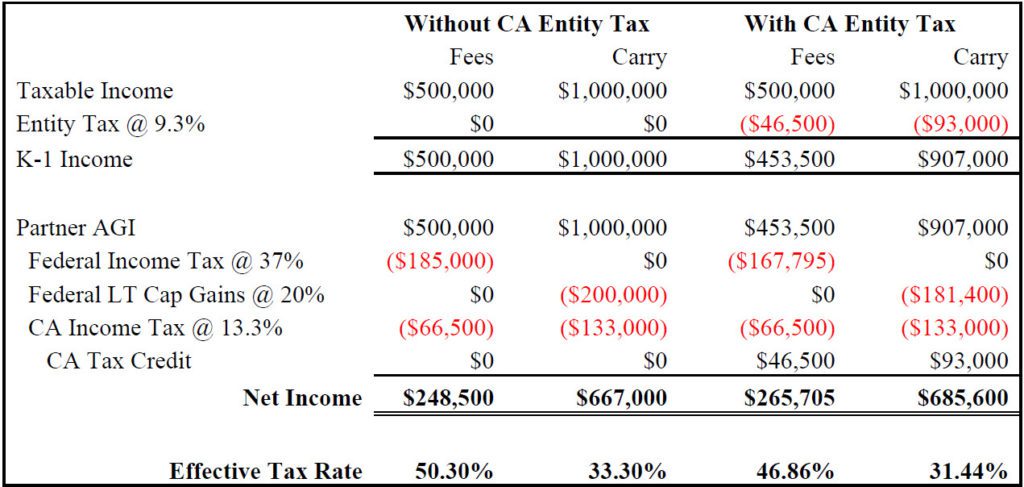

And while its presently due to sunset in 2025 Suozzi. The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. The lawmakers have asked the US. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. The Washington-based Institute on Taxation and Economic Policy has. Dave Goldiner New York Daily News 1152021.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions.

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Client Alert Gov Newsom Signs A B 150 Salt Workaround Shartsis Friese Llp

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

The Salt Democrats Surrender Wsj

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Are Democrats Worth Their Salt Wsj

Pro Salt House Dems Say They Ll Back Spending Plan

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

Local Business Alert We Are Lucky To Live In A Place Where Local Businesses Are So Colorful And Significant We D Like To Local Charity Tax Help Wardrobe Rack

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan